With everyone and their grandma turning to the internet for pretty much all of their needs, their financial needs haven’t remained an exception either.

In fact, with the abundance of quality financial information available online and the ease of access to it, using digital media for searching for financial advice and even financial planners is a no-brainer.

But how can you – as a financial planner – capitalize on this opportunity and tap into this goldmine of potential customers? We have 10 great ideas for you to get going.

Designing and Optimizing Your Website

While there’s actually a long list of things you can do when doing digital marketing as a financial planner, the very first thing you need to do is getting a website designed the right way and optimizing it for conversions.

After all, without a professional-looking, well-optimized website, you’re likely to end up losing a major part of your potential customers even after managing to drive targeted traffic to your website.

And when we say a professional website, we don’t mean a fancy design loaded with style elements. The website needs to have a clean, distraction-free look, which helps both convert your visitors better while also helping your website load faster.

Get Noticed Locally

Digital marketing isn’t always about getting the big wins, especially for small businesses. The foundation of digital marketing for financial planners or a small business would be to build a local presence.

It’s easier to get targeted traffic locally, and it also tends to convert better as customers have an increased trust factor towards a business that’s near to where they live.

While GMB (Google My Business) is a no-brainer to start with, there are usually also local directories that you can get listed in. It not only helps you increase your local exposure, but the directory backlinks and local citations also help with SEO.

Take Keyword Research Seriously

As a financial planner it’s important to find out what your target audience is searching for in Google and other search engines. This will give you a lot of foundational insight that you will need to build an effective content marketing plan.

And when it comes to digital marketing, there are not many other elements more important than your content and how you plan it.

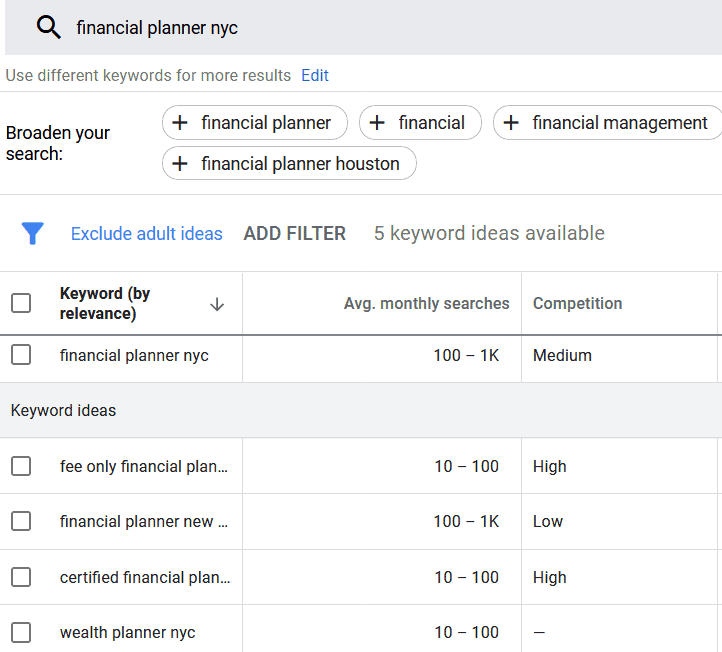

Keyword research is actually pretty simple if you know the process you should be following. A basic process for beginners would simply be to use Google AdWords to get keyword volume estimates and find related keywords in their niche that their target audience is searching for.

So as a practical example here, if you were a financial planner based in New York, you would enter “financial planner NYC” into the Keyword Planner tool of Google AdWords as your seed keyword or topic and get the above results.

Besides getting an estimated search volume for your main keyword, you would also find other related keywords that your target audience is searching for as you can see in the above image.

You then use these keywords naturally in your content, so that Google can pick up your website’s pages for those keywords and rank them for the keywords.

Use the SEO Power

If you aren’t doing SEO for your business, you’re probably missing out on the best type of target audience which is the easiest to convert into customers. This is because with SEO, you target potential customers that are actively looking for the services you offer.

But SEO isn’t just about including keywords in your content or sub-headings. There’s a lot more to it, especially with off-page SEO that involves a lot of technical work and building backlinks.

So if you’re looking to utilize the power of SEO seriously, you need to hire a professional who truly understand SEO and also your particular niche.

A good social media presence isn’t going to get you a lot of clients right off the bat, but it’s great for building your brand image, increasing your credibility, and for long-term growth of your business.

When designing and executing a digital marketing strategy, it’s good to think long term, and social media marketing should be an important component of a long-term digital marketing strategy.

While getting yourself on all the major social media platforms doesn’t hurt, you must focus on one or two platforms for the most part that are likely to get you the most results depending on your target audience.

Make sure you use your social media presence to showcase your experience and knowledge through your posts, while trying to actively engage with your target audience and building a relationship with them over the long term.

Utilize Email Marketing

Email marketing is probably one of the most underrated digital marketing ideas or tactics. However, it offers some unique advantages that can bring a lot to the table in terms of long term results for your business as a financial planner.

With email marketing, you can build a list of potential customers who may turn your customers in the future, give you repeat business over the long term, send referrals your way, or even purchase any informational products you may launch in the future.

To give a good reason for your website visitors to turn into email subscribers, offer an incentive to your website’s visitors to subscribe to your emails in the form of a guide about an important topic in your niche that they tend to care about. Keep sharing useful content and advice with them through your emails – don’t just try to make money out of them by sending a lot of promotional emails.

You can occasionally send them discount offers, free consultations, invitations to your free webinars and introduction to your latest products or services. Even if these emails don’t get you direct sales you can build a funnel using them that will eventually convert a lot of your email subscribers into customers over time.

Image credit: AWeber

Organizing Free Webinars

Talking about free webinars, they are an excellent way of attracting potential customers and converting them into your clients at a great conversion rate.

Don’t get me wrong. Your webinars have to be useful for the people who attend them and not just for selling your services.

In fact, when you’re offering some real value to your target audience through these free webinars, they will be much more likely to convert into customers as they will get a first-hand experience of the benefits of your services and how knowledgeable you’re about your niche.

Google Reviews

The reviews on your Google Maps or GMB (Google My Business) listings have a great impact on your rankings in Google’s Maps results.

And raking in your area’s Google Maps results directly translates to a lot of warm leads for your business.

So make sure you ask every happy client to post a review of your service on your Google Maps listing, and also send them the link to your listing as it would be too much to expect them to find it themselves.

Facebook Ads if You Have the Budget

Facebook offers so much in terms of advertising tools and targeting options that no matter what your niche and target audience is, chances are you can find them through Facebook ads.

After all, a large majority of Americans use Facebook regularly, and that includes your target audience as well.

But setting up successful campaigns with Facebook ads isn’t easy and involves a lot of testing. It’s best left to professionals, as you may end up burning a lot of money if you try to do it yourself.

However, you would still need a decent budget to actually get some considerable results with Facebook ads even when working with a professional. You shouldn’t expect to set up profitable campaigns with a few hundred dollars when just starting out.

Follow Up with Your Existing or Past Clients

As much as it might seem that your past or existing clients would just get in touch with you if they need your services or to know about your products other than the ones the are already using, you would actually be surprised with how much business you can get just by doing a simple follow up with them.

Many times, your customers just aren’t active enough to ask or find information about your financial products or services. Simply reminding them that you can offer what they are looking for or what might help them further on top of the services they are already using can go a long way in building long-term customer relationships and getting a fair bit of business without spending a single dollar in advertising costs.